Implications of the 2024 Election on the Agency M&A Market (Updated)

A few months ago I wrote a summary of the implications of the 2024 presidential election on tax rates and the M&A market. At that time, Joe Biden was the candidate and I commented both on Biden’s tax proposal and Trump’s. As we all know now, VP Kamala Harris has been nominated as the Democratic Party candidate. Harris recently released details of her tax plan, which present the case of raising tax revenue by $5 TRILLION over a decade.

How Will the 2024 Presidential Election Impact the Agency M&A Market?

Here are some key highlights of how Harris intends on increasing tax revenues:

1. Corporate Tax Rate

Harris supports Biden’s proposed 28% tax rate on corporations and has floated a 35% tax rate, both of which are drastically higher than the current 21% corporate income tax rate.

2. Capital Gains

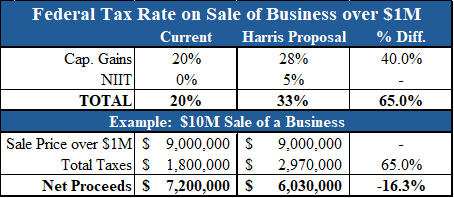

Harris is proposing to tax capital gains at 28% for taxable income over $1M. Harris is additionally proposing to raise the net investment income tax to 5% (currently 3.8%) and include non-passive income, which in short adds a 5% capital gains tax to everyone that sells a business and earns over $400k. The combination of these two factors will raise the federal capital gains rate on gains over $1M from 20% to 33%.

3. Top Individual Income Tax Rate

Harris supports raising the top individual income tax rate to 39.6% for the highest earners, in line with Biden’s proposals.

4. Premium Tax for Medicare for All

Harris introduced a 4% premium tax on individuals earning over $100,000 to help fund Medicare for All, which deviates from Biden’s commitment to not raise taxes on families earning under $400k per year.

5. Estate Taxes

Harris has proposed taxing unrealized capital gains at death that are above a $5M/$10M (individual/joint-filing) exemption. In other words, the intent is first to cut the lifetime gifting/estate exemption in half and then tax it upon the grantor’s death even though the beneficiaries may not sell the assets.

6. Carried Interest

Lastly and as with Biden, Harris has proposed taxing carried interest, which are earnings from private equity, venture capital, and hedge funds, as ordinary income. Given the impact that private equity investments have had on the M&A market over the last decade, the affect of increasing investors’ tax rate from ~20% (capital gains) to likely 39.6% (ordinary income) shouldn’t be ignored. As investors’ ROI projections go down so do business valuations.

Potential Impact on Agency Sellers

Cutting to the chase, Harris’s plan raises capital gains taxes by 65% (from 20% to 33%) on gains over $1M. If you were, for example, selling your business for a gain of $10M under this plan, you could expect to walk away with ~$1.2M less, which is likely 2 years of income net of ordinary taxes.

The Bottom Line

Not unexpectedly, both Harris and Biden favor more aggressive tax rates on higher earners. By increasing capital gains taxes, the plan reduces that take-home net proceeds of business sellers. By increasing ordinary tax rates on corporations and treating carried interest as ordinary income, the plan reduces returns (ROI) obtained by business buyers.

If Harris wins the presidency and her tax plan is enacted as proposed (a lower probability), I would expect a slow down in M&A and a decline in valuations. The turn in the market won’t be as dramatic as the late 2000s but higher taxes will deter owners from selling and buyers from paying today’s multiples.

One looming question is whether or not, if elected, Harris would pursue enacting the tax hikes retroactively. While there is not much precedent for a retroactive tax increase, it is on the table depending how the election cycle shakes out.

If you are thinking about selling your agency in the near future, give us a call for a confidential discussion.

References:

Posted by:

Michael Mensch, Founder and CEO

Direct: (321) 255-1309

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us