Insurance Agency Marketing

One of my favorite hobbies is studying marketing trends and tactics. Insurance agents have a wide range of marketing tools and options at their disposal. It’s the reasons that the insurance brokerage business is one of the best for marketers. Some avenues of marketing work well for engaging personal lines customers, while others are best suited for commercial lines customers. Some avenues work well for a broad audience, while others are best suited for a targeted demographic.

I have had the pleasure of working with some exceptional entrepreneurs that use all sorts of methods to effectively grow their business. Following on the heels of my most recent webinar “Best Practices for Growing an Insurance Agency”, I thought it might be a good idea to share my thoughts on the subject.

Marketing Plans

According to a recent study, over half of insurance agencies have no formal marketing plan and do not track where their leads are coming from or their ROI from marketing.[i] That’s an astoundingly high percentage when the rewards, on a long term basis, of capturing new clients have such a high ROI. The basis of a marketing plan can be as simple as the following:

- Assess the market place looking at opportunities, the resources that you have, and the competitive landscape.

- Identify your target customers.

- Develop a value proposition to position your agency above the competition.

- Create your marketing materials and prepare your sales processes, which may include gaining access to the right carriers (not always an easy task but that is not the topic of this article).

- Promote your agency via the best channels to reach your target customers.

- Track the performance of your marketing efforts and make changes as needed.

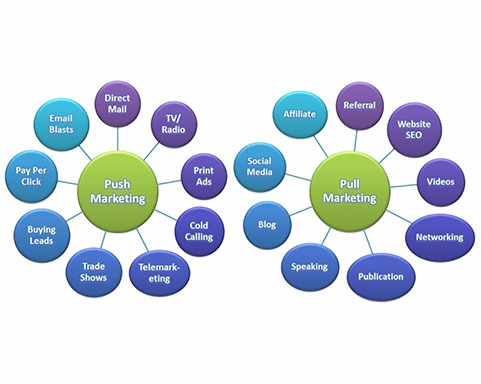

Your target customers can be anything from property and vehicle owners in a specific area, to a certain class of business owners, to public entities, to just about anything. People have insurance for everything now-a-days including even their pets. When it comes to marketing options, I like to break them into two categories: (1) push methods and (2) pull methods. The schematics below illustrate the options. Generally speaking, push marketing includes methods that “push” your brand in front of consumers, while pull marketing are methods that attract consumers either by them looking for the best options or by way of reputation.

I have known agency owners that have used every single method shown in the illustrations to grow their business. There is no right or wrong approach, only ones that work best for your target customer. The key to picking the right method(s) is to understand the customer’s purchasing behavior and use avenues that reach a high volume of potential prospects.

Marketing Online

Another recent study presented the following statistics:[ii]

- 12% of agencies still have no website.

- Only 14% of agencies have a website targeting a specific industry.

- 54% of agency websites are not mobile-ready.

- Over 65% of agencies do not have customer testimonials on their website.

- 38% of PL agencies and 49% of CL agencies are not using Social Media.

- 67% of agencies do not have a blog.

- Over 50% of agencies do not have in-depth content on their website.

- 39% of agencies are not using local search tools.

The internet has radically changed the world of business. Businesses in small towns can easily attract customers across their state, county or even the world if they wanted. The cost of doing so as compared to older, more conventional methods like direct mail, print ads, TV and radio, is miniscule. Every business should be embracing internet marketing. Websites, blogs, videos, and social media marketing can all be done on a low budget and yield a high return when executed effectively.

The beauty of the internet for marketers is the high level of analytics available. Whether through email campaigns, PPC ads, websites, YouTube videos, or social media, all methods running through the internet have various tools that can be used to study traffic. Even though Google continues to frustrate marketers with its updates, such as the recent one in which it has blocked key word tracking, you simply can not beat the level of information that it provides.

Society is only going to increase its reliance on the internet and digital methods for researching and consummating purchases. The same report stated that web traffic via mobile phones is growing by 3.5% per month and that 88% of local advertising will be delivered by mobile phones by the year 2016. If you have not adapted to marketing online, then I would highly recommend that you start. Those that have embraced new marketing trends will reap the rewards over the coming years, as many are doing now from efforts they initiated a few years ago.

Specialization

To the point of only 14% of agencies having websites targeting a specific industry, the commoditization of insurance has created worry by a number of agents. The consulting firm McKinsey & Company released a report last year in which they predicted the “end of an era for the local insurance agent”.[iii] This report was met with a loud response from agents. While I think it is a little overhyped, there has been a market shift in consumer purchasing behavior in lines such as auto and health insurance. The hay day of profitability of those lines are probably coming to an end but smart agencies have adjusted to compensate. In the last few years, the number of agencies claiming an area of specialization has risen by 10%.[iv]

The potential benefits to specialization include: (1) faster organic growth, (2) higher retention, (3) higher profitability, and (4) a stronger value proposition to consumers. The old adage “There are riches in the niches” is true. Agencies that specialize tend to be more profitable. I’ve consulted with a few in the $1.5M to $6M revenue range that had above average profitability. A few even as high as 65% of revenue – a level that is unheard of for agencies of their size.

The key to succeeding in a specialization is to choose an industry that you understand and have a passion for, and then build a separate brand and marketing plan. Most agencies often have a practice leader heading it up, which may be the owner. Growth may be slow in the beginning due to challenges such as having access to the most competitive markets, but those will be overcome with time. Specialized agencies learn the ins and outs of their target industry and become experts at underwriting the risk, which then leads to lower loss ratios and carriers chasing them for production.

Tracking Marketing Performance

Successful agencies owners have a pulse on their business, particularly their marketing and production. They track how much is spent on various campaigns, how many leads come in, the closing ratio of those leads and their sales staff, cross sales, and the traffic generated from email, internet and other digital marketing. I have seen agencies indiscriminately spending hundreds of thousands of dollars on marketing with little results, and similar sized agencies spending 1/6th as much with a higher rate of growth. It is very easy to waste money in the realm of advertising and marketing, and companies selling those services are more than eager to take it!

Keep up with marketing and consumer trends, invest in growth, monitor the effectiveness of your marketing dollars and sales staff, and your business will grow. If all else fails, study those that are successful and do what they do.

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us