Insurance Agency Valuation Multiples

There are some misconceptions in the insurance industry relating to transaction multiples paid for agencies. Our company performs over 10 agency valuations each month for principals, buyers and lenders around the country. I have personally overseen more than 600 agency valuations, and negotiated nearly an equal number of offers for clients including with privately-held agencies, bank-owned agencies, private equity backed brokers and publicly-traded brokers. I say this so the reader has some comfort with the information that is presented.

The first thing to understand is that there are typically three multiples that factor into the value of an insurance agency. Those factors are the multiple of:

1) net revenues,

2) discretionary earnings, and

3) pro forma or adjusted EBITDA.

For reference, the acronym EBITDA stands for Earnings Before Interest, Taxes and Depreciation, where taxes refer to income taxes. The valuation multiple that should be considered depends on the size of the agency and type of buyer.

While it may be helpful to know the total premium volume, or even commission volume if the agency wholesales business, it is the “net revenue” that pays the bills. The volume may play into the valuation if there is an opportunity for the buyer to enhance the net revenue by getting better commission rates, overrides or contingency income but generally the buyer is focused on the real historic revenue. The discretionary earnings is a pro forma estimation of the total compensation the agency yields to a working owner-operator. Start with the net income of the business and add back the owner’s salary and other compensation, interest on debts, depreciation/amortization and any non-recurring or non-essential expenses to determine the discretionary earnings. Some allowances are given if certain expenses can be adjusted going forward without impacting the operation of the business. A pro forma (forward-looking) or adjusted (historic) EBITDA is essentially the discretionary earnings minus a reasonable compensation for either retaining or replacing the owners(s). All three multiples might be net of non-commission income depending on the consistency of the income sources.

All of the multiples that I quote herein should be considered including 85% or greater in guaranteed price, except in the cases where the agency generates 15% or more of its revenue from accounts with greater than $50,000 in premium. It is not uncommon for the seller to carry part of the transaction in the form of retention or earn-out based compensation, but the amount is generally low in today’s market. The multiples presented should be considered as having a +/- 15% variance on price for any specific agency. These are completely financial-based analyses that assume a stable revenue/earnings stream, unless otherwise specified, with comparatively low risk (i.e. no serious potential loss of revenue apparent). I give myself a 30% variance (i.e. +/- 15%) because there are a number of other qualitative factors that weigh in, such as location of the agency, quality of the carriers, customers and staff, the agency’s automation and marketing processes, etc. A true market valuation requires a thorough analysis of many factors. The intent here is to provide ballpark metrics for those seeking such information.

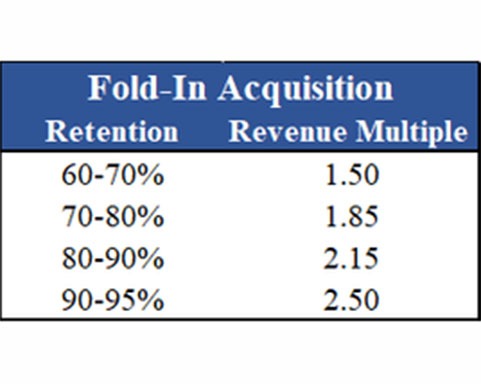

A multiple of revenue is primarily only used when a book of business is being acquired, i.e. the buyer is not assuming overhead expenses. In such case, the buyer will have a different cost structure. The key focus will be on the historic retention rate of the book of business. Having run hundreds of discounted future cash flow (DFCF) models based on various retention rates, I can give you an estimate for different ranges. A DFCF projection essentially looks at the current value of the future income stream from the book of business with taking into consideration the depletion of revenue over time due to attrition from the loss of accounts.

Keep in mind that, even though your historic retention might be 85%, when the book transfers ownership the retention will go down. The decline will be more profound for accounts that require contact with the client, such as agency billed accounts. Additionally, the buyer will always have costs associated with managing the book of business, so the net at best is likely 65% of revenue. Note that I’m referring to “fold in” acquisitions above. Stand alone, or particularly larger platform, operations can sell at higher revenue multiples if the profitability supports it. I also leave out books with retention over 95% as I’ve seen a few wild cards that would value much higher for unique reasons.

A multiple of discretionary earnings is the primary valuation factor when the agency has revenues of $250k to $750k, because the revenue is sufficient to justify keeping the office and staff but not high enough to necessarily attract buyers that are looking for platform operations (more on this later). If the buyer is looking at acquiring the agency with the current cost structure and is financing the transaction, then the discretionary earnings sets the value.

Transactions in this size range are typically done by buyers that require financing, hence my analysis is strongly based on assessing the financing terms (length, amount, cash flow after debt service and debt service coverage), which is to say that I look at it from the lender and buyer’s point of view. There must be enough cash flow to cover the loan payments with a coverage ratio and provide a reasonable return/income to the purchaser.

There is a gradual scale between those agencies in the above category, and those that fall into the category of being valued on a multiple of pro forma EBITDA. The reason is because the type of buyers change as the agency gets larger. As your discretionary earnings start to exceed $300k, then the buyer will be more ROI-driven, such as high net worth individuals, private equity-backed groups, national brokerages or banks. Such buyers are focused on their return after paying all of the expenses including a management expense, which might be to the seller if he/she stays on or to an employee. Typically assume that such a management expense will be 10% of revenue, hence the pro forma EBITDA might be close to the discretionary earnings minus an additional 10% of revenue. The management expense can be higher if the owner is also a producer for large or specialty accounts. Then the replacement cost will be at a fair producer compensation rate of maybe 25-30% of the owner’s book of business. If your agency is running above or below a typical profitability level, then a buyer may make a pro forma adjustment to expenses to bring it closer to their own corporate profit margin as well.

I said that this is a ballpark estimation and gave myself a 30% range on those numbers presented. At the end of the day, if there is a demonstrated financial benefit for someone to buy an insurance agency or book of business, then someone will buy it if the business is marketed properly. The qualitative factors influence the market value within this range, and the types of buyers that the agency attracts.

Some people might ask why I am giving away such insider information, the reason is because:

- If you need a valuation of an insurance agency for tax or legal purposes, then this information is helpful but you will still need a formal valuation report.

- If you are looking at purchasing an agency or book of business, a formal valuation report can assist with your due diligence and function as a negotiating tool with the seller.

- If you are considering selling your agency, then you need a skilled and experienced M&A advisor to:

- Prepare and effectively market the agency for sale to the most strategic and financially qualified buyers.

- Help you screen and qualify the buyers before revealing confidential information.

- Create a bidding competition to realize the highest and best deal, including negotiating the pro forma, price, terms of payment, asset allocation for taxes, liability limitations and working capital requirements. Just because an agency is worth “x”, does not mean that every buyer will pay it.

- Keep the pressure on and the process organized so that the sale moves forward diligently. This includes managing due diligence, financing approval (when applicable), carrier approvals and assisting with the often tedious contract schedules needed for closing. Time is of the essence and good things seldom come out of delays.

- Act as an intermediary between you and the buyer to buffer the emotions and personality challenges that always arise during a sale transaction.

Please feel free to contact me directly at (321) 255-1309 if you should have any questions about this information or our services.

Posted by: Michael Mensch, CBI, M&AMI and Managing Partner (click to connect on LinkedIn)

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us