Insurtech Valuations: Where is the ROI?

Hippo recently announced that it sold a majority stake in First Connect for what appears to be a valuation of about 6 x revenue. I’m basing that on the $60M price and comment that November plus December revenues were expected to be between $1.5M and $1.8M (~$10M annualized). The article also noted that the sale would have a negligible impact on Hippo’s losses, meaning that First Connect doesn’t generate a profit.

I have an opinion on this topic, having evaluated several networks and Insurtech’s and having represented a few through sales. This is the lengthiest article that I’ve written so grab a drink and get comfortable while I step up onto the soap box.

Why the Buzz about Insurtech?

We see insurance firms being pitched as Insurtechs frequently nowadays. The motivation to be labeled an “Insurtech” is the higher perceived market value of tech businesses over traditional insurance businesses. As one client said to me some years ago, “I’m told we can get 20 x EBITDA if we position our agency as an Insurtech!”

What really makes a tech company worth more than a traditional insurance firm?

Investors want a return on their money that is proportional to the investment risk. For an investor to pay 20+ x EBITDA, which is an extreme multiple for any company, necessitates that either the risk is almost non-existent (20 x EBITDA = 5% ROI, similar to a Treasury Bill) OR that there is high confidence that the value will grow significantly in the future (e.g., so that the 20 x eventually becomes 10 x).

For tech companies, the driver for extraordinary multiples is always the prospect of value growth. Think of Amazon, Netflix, Apple, and Tesla – their earnings multiples were off the charts at times because the market was confident in their ability to grow revenue and earnings significantly in the future. One fundamental difference between the aforementioned tech companies and Insurtechs is that the former created a market (blue ocean) while the latter is attempting to capture market share from an entrenched, competitive marketplace (red ocean). Tech companies sell tech products too; whereas most Insurtech’s are leveraging technology to sell an intangible product.

“Available for Acquisition”

Years ago, we evaluated an Insurtech that was just under $10M in revenue. The company was being pitched to a client for acquisition. It had double digit revenue growth but was hemorrhaging cash with net losses piling up to well over $50M. Despite the massive losses, the sellers’ representatives were arguing that expenses could be gutted to generate an EBITDA margin over 75%.

We received a data dump for due diligence and went to work analyzing the business. In the end, my conclusion was that the business model was flawed, and business would struggle to achieve profitability (or run-off rapidly if expenses were cut dramatically post-acquisition, per the advisor’s proposal). My advice to the client was to pass on the deal.

The reason? Customer retention was too low and costs, including those to acquire new customers, were way too high. The company was spending 70-80% of its total revenue on sales & marketing alone and only generating 10-15% annual growth.

The Insurtech company, which no longer exists, checked the boxes:

- Catchy name

- Smart executives

- Great culture

- Tech-enabled

- Double-digit growth

They failed in two key areas: (1) not understanding the nature of the customer they were targeting and (2) not having a proven profitability model. On the former point, the company targeted online shoppers of insurance, who tend to be price-sensitive and churn (e.g. retention of 55-70%). On the later point, the company, backed by a VC firm, focused on top-line growth as if building a SAAS and ignored costs.

The pitch deck looked great. The financial performance was a nightmare.

Why Most “Insurtechs” are Not Worth Extraordinary Valuations

Value to investors is derived from cash flow and equity growth. Since most Insurtech’s are not selling tech products, then the value of the tech is in leveraging it for growth and efficiency (i.e. equity growth). This is where the rubber meets the road. I don’t care if you are an agency or a carrier. How is the tech driving equity growth?

Let me focus on the capital backed Insurtech’s, as this is the most visible group.

1. They seldom drive revenue growth with tech.

- New business engine: While presenting the illusion of driving growth through technology, most of these firms do it through traditional means like paid ads, buying leads, hiring sales teams, and making acquisitions. They only achieve high growth due to the massive pool of cash given to them, as compared to firms building without capital backing.

- Revenue per customer: Aside from originating new business, one way tech could help grow revenue is through data analytics to help maximize revenue of existing customers. From my experience, the revenue per customer of Insurtech’s though is, at best, on par with their traditional competitors.

- Customer retention: A third way that tech could help drive growth is through customer retention. If you keep more customers, then you don’t have to add as many to achieve growth. Again, from my experience, Insurtech’s don’t appear to out-perform their traditional competitors in terms of customer retention – despite investing heavily into customer-friendly technology.

2. They seldom operate as efficiently (profitably) as traditional competitors.

- Higher payroll expenses: Since the objective is to grow rapidly and develop new tech, these companies hire way before their revenue supports the payroll, and average higher compensation per person. It’s not uncommon for payroll, as a percentage of revenue, to be more than double that of the industry norm.

- Higher technology expense: Compared to traditional competitors, who utilize tech on a needs-case basis, capital-backed Insurtech’s load up on technology, spending 5 to 10 times more as a percentage of revenue, most of which is for licensed software.

- Customer demographic: As noted, Insurtechs gravitate to customers that generate lower revenue and/or have higher turnover. Revenue per customer and retention are key components to building a profitable insurance business. You can 100 x the business but if your model is wrong, then you will struggle to hit profitability, which is what I’ve observed.

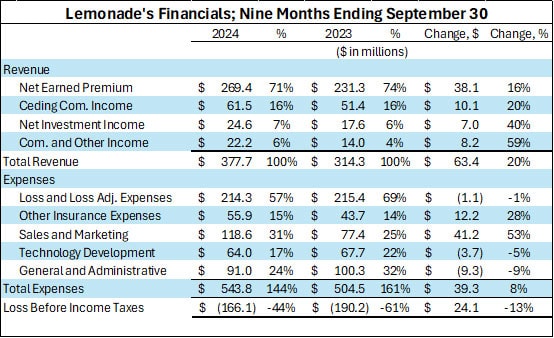

I mentioned the Insurtech we evaluated that was shy of $10M in revenue after burning well over $50M in cash. Let’s look at one Insurtech that has taken the stage, Lemonade[i], which has been described as “revolutionizing the insurance industry.” Here is a snapshot of its financials for the nine months ending September 30, 2024, compared to the prior calendar year.

This is a beautiful picture of what I’m talking about.

- Growth: As a percentage of total revenue, Lemonade spends 2 to 4 times more than other carriers in Sales & Marketing, which includes agent commissions for other carriers. Of the increased Sales & Marketing expense in 2024, 98% went to marketing/advertising. Lemonade grew its revenue 20% in this time frame. Other carriers (e.g., Progressive, Travelers and Chubb) grew 10-17% in the same period, one during which many carriers were attempting to reduce business.

- Revenue per customer: Lemonade’s average revenue per customer was about 1/6th the industry average ($384 vs ~$2,500).[i] In other words, the company will need ~6 x more customers and be able to sell & service them at 1/6th the cost per customer to match the performance of a traditional competitor.

- Customer retention: The company seems to prefer referencing premium retention, which was 87% the last year[i], as opposed to customer retention. Matteo Carbone mentioned in a 2023 post that the company had a 30-40% churn rate[iii] (i.e. 60-70% retention). Given that most of its traditional competitors are retaining 80-87% of their customers (half as much churn), the company has to sell twice as much business to stay flat.[iv]

- Profit: Most carriers earn 10-20% pre-tax profit on their total revenue. Lemonade’s profit was up … to negative 44% of total revenue. They could cut 100% of their G&A and technology spend and still be in the hole.

The point that I am trying to hammer home is that we’ve been listening to hype about Insurtech for nearly a decade now, but where is the real disruption? Global Insurtech investments passed $1.38 billion in Q3 alone.[v] Investors have plowed over $30 billion dollars into the space.[vi] Where are the big successes? Which Insurtechs have demonstrated an ability to grow profitably?

Going back to First Connect, kudos to Hippo for selling the platform for what I think was around 6 x revenue. I have not seen First Connect’s financials or book of business, so I can only make a surface-level assessment based on what is on its website and what I know about other networks. My guess is that its target demographic is smaller agencies that need a market for lines of business that those agencies don’t write frequently (e.g., cyber, small BOPs, manufactured homes, recreational vehicles, etc.).

The platform lacks relationships with key carriers that dominate in different regions of the country, like Travelers, Safeco, Liberty Mutual, Progressive, and Mercury. Therefore, First Connect will need to sign up a high volume of agencies, likely in the thousands, which will be tough to accomplish since over half of agencies are already a member of a network.[vii] Supporting a high volume of low production members adds significantly to administrative costs vs networks that work with fewer but larger agencies too. Outside of market access, most agencies join networks to become part of a club to share best practices and build relationships with other principals. Tech can’t replicate relationships, and that is an ongoing struggle for the space.

The Bottom Line

My intent with this article wasn’t to play the role of Statler & Waldorf and just poke fun from the balcony. It was to draw attention to two key points that I believe are being overlooked in the mad rush to “revolutionize the insurance industry.”

- Market Strategy: You can build a great brand and innovative tech but if you target the wrong market segment, then the business will flounder and possibly fail. You have to get the financial modeling right, including cost of customer acquisition, revenue per customer, and customer retention, before ramping up. A Field of Dreams mentality won’t cut it in a red ocean.

- Equity Growth: The goal of whatever tech you build should be to drive equity growth, either through revenue growth or through efficiency. If it doesn’t do either, then the tech is just an added cost that will eventually get eliminated when the business runs out of cash.

I’ll end by admitting that there is a lot I don’t understand about the Insurtech space. I’ve been privy to some behind-the-scenes data, and we’ve seen some big publicly announced failures in the Insurtech world (like WTW taking a ~$2 billion write off after the sale of the digital platform Tranzact).[viii]

I don’t understand why Lemonade, Root, and Hippo have $3.28 billion, $1.28 billion, and $648 million enterprise values, respectively, though when each one has been burning cash like trash in a homeless camp. I don’t understand why VC investors would plug $60M behind an insurance business that has $10M in revenue with negative cash flow and an unproven profit model. At some point these businesses need to make a profit, and one that supports the massive investments. I think that will be very challenging for some of them.

Time will tell the story of which Insurtechs survive. It will be interesting to look back and see exactly what ROI investors collectively obtained on Insurtech investments. As I joked on LinkedIn two years ago, R.I.P. to the revenue multiple and long live the ROI!

Posted by: Michael Mensch, Founder and CEO

Direct: (321) 255-1309

[i] https://investor.lemonade.com/financials/sec-filings/default.aspx

[ii] https://finance.yahoo.com/news/lemonade-inc-lmnd-bull-case-194504843.html?.tsrc=rss

[iii] https://www.linkedin.com/pulse/synthetic-bults-matteo-carbone/

[iv] https://discover.jdpa.com/hubfs/Files/Industry%20Campaigns/Insurance/2023USINSLISTQ1Report04202023.pdf

[v] https://www.insurancebusinessmag.com/us/news/reinsurance/ai-and-megarounds-drive-recordhigh-insurtech-funding–gallagher-re-513508.aspx

[vi] https://www.carriermanagement.com/features/2024/11/14/268559.htm

[vii] https://www.networksalliance.com/networks-study-summary/

[viii] https://www.insurancejournal.com/news/national/2024/10/01/795187.htm

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us