Never a Fee to the Seller!

Thinking of selling your agency and receiving an ad promoting “Never a Fee to the Seller!”? You might want to take time and do your due diligence. This is a clever but deceptive gimmick. Here’s why:

- The broker’s fee is added to the transaction. As true with any purchase, buyers look at the total cost to acquire a business. In essence, what the seller is receiving is reduced by the broker’s fee.

- The seller does often end up paying the broker. These brokers work with individuals that have to borrow money for the transaction, versus larger cash-buyers. Many lenders, such as SBA lenders, will not finance buy-side broker fees, so the only way to get paid is to add the fee to the price and have the seller pay the broker.

- The seller may not be getting the highest price and best terms on the sale. The broker is only working with a limited number of buyers that have agreed to pay their fee, many of which can’t win in a competitive bidding environment. The broker also works for the buyer, so he is not looking out for the seller or trying to maximize the seller’s transaction value.

- The broker is just attempting to get his foot in your door. The individuals that typically use these tactics do so because they are inexperienced and do not have a strong value proposition to engage agency owners. They are attempting to throw spaghetti against the wall to see if it sticks, so to speak. They want to introduce you to buyers, step back, and then run you in circles, answering questions hoping that something will transpire so they can get paid. It can be a big waste of your time and opens up the possibility for breaches of confidentiality.

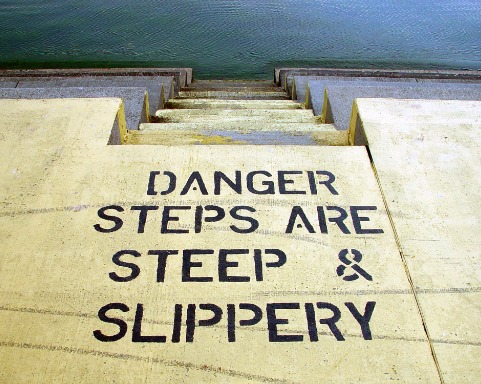

Before responding to such ads, there are three critical questions that you should be able to answer by doing some research online:

- How long has the business been in existence? Most states have an online database of registered corporations where you can check the date the corporation was created. The firms using these tactics claim that they have been around for much longer than they actually have, and a quick check of the state corporation website can determine the truth.

- How many transactions have they completed? Experienced M&A firms list both completed transactions with the names of companies involved, and client testimonials, on their website. The firms using these tactics are making outlandish claims about the number of transactions that they have completed but show very few, if any, transactions or testimonials on their website.

- Based on #1 and #2 above, has the firm represented itself truthfully? If they have been dishonest thus far, then you should probably avoid them.

We’ve picked up a number of clients that fell for this gimmick. The old adage of ‘you get what you pay for’ holds true. If you need guidance on what to look for in a transaction professional, see my prior post, “Insurance Agency Mergers and Acquisitions”. If you are seeking to sell your insurance agency, then hire professional representation that will be working on your behalf to protect your interests and maximize your proceeds. A successful sale requires proper planning and professional advice.

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us