Should an Insurance Agency Hire a CFO?

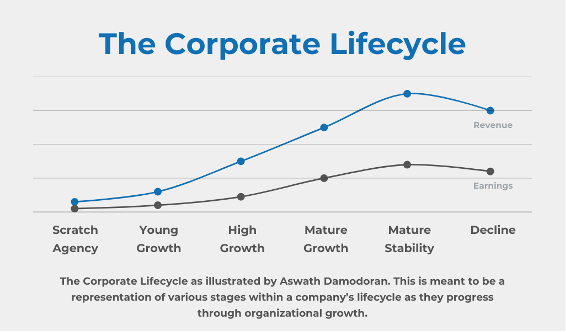

Whether an insurance agency should hire a CFO will depend on several factors including the agency’s size, goals, and their organization. When and how they hire is influenced by what stage an agency is currently and the strategic experience needed to get to the next level.

What is a CFO?

A Chief Financial Officer (CFO) is a senior executive responsible for overseeing the financial strategy, operations, and performance to guide an organization. A CFO’s role can be crucial for aligning an agency’s performance and financial resources to ensure the company remains financially fit and aligned to achieve its long-term goals.

The role of a CFO can have different responsibilities depending on the stage of the company and what its owners or stakeholders are trying to accomplish. For example, the CFO of a large company preparing for an Initial Public Offering (IPO) can be responsible for regulatory filings, preparing the organization for reporting requirements, and other financial compliance needs. The CFO of a smaller company often may have oversight into the financial performance, operations of the business, and even help the owners align agency performance with their personal goals.

What is a Fractional CFO?

A Fractional CFO offers strategic financial planning, analysis, and guidance to a business owner at a scaled level compared to having a full-time executive staff member. Provided as a service, a Fractional CFO delivers executive-level oversight into an organization’s financial operations and resources aligned with the owner’s goals. This can include things such as organizational planning, financial turnaround, growth strategy, M&A support, and exit planning. For many agencies, it may not make sense to have a full-time CFO at the initial stages of your journey, but a Fractional CFO can give you access to the same level of expertise and value prior to needing a full-time Controller or CFO.

It is also common for agencies who utilize a CFO title to include other duties such as managing producers or sales, overseeing operations, and other administrative functions. It may be that even with a CFO title, they only dedicate 20-25% of their time and attention to managing the agency’s finances. A Fractional CFO is a perfect opportunity for an insurance agency to have corporate-level financial reporting and guidance without the full-time salary or commitment of a CFO.

A Fractional CFO is not a bookkeeper but works with the existing accounting staff (whether in-house or outsourced) to establish best practice standards for recording, reporting, and then using that information to guide the agency toward its forward-looking goals.

When should an insurance agency hire a CFO?

Like many questions, the answer is “it depends.” In my personal experience, the need for financial staff evolves over time as the agency matures. There isn’t a perfect guide that says at X dollars of revenue you need this specific role in your staff, but there are some milestones that help indicate when bringing on certain expertise can bring significant value to the agency.

Startup or Scratch Agency Stage

When an agency is in the launch or startup phase the principal may handle most of the accounting or financial functions on their own. Depending on if you are the sole employee or have staff there can be the need for payroll services, tax filings, some advice on categorizing expenses, and even budgeting. However, for many agencies in this stage the primary financial function here is bookkeeping done by the principal and tax preparation or advice from a CPA. Budgets and forecasting are certainly important at this stage, but the primary focus for most agencies here is acquiring customers and beginning to hire service or sales roles.

For most agencies, a CFO at this stage may not make sense, but a Fractional CFO can help with projects such as budgeting or forecasting, staff planning or compensation, and strategic planning.

Growth Stage

At a certain point, the administration functions for an owner or principal agent become an inefficient use of their time. Either hiring or outsourcing certain functions makes sense for you as the owner or manager to get a better return on your attention either through production, solidifying procedures, and other initiatives to position the agency for growth. As the agency owner, you start to recognize specific roles and responsibilities needed to enable growth such as an operations or department manager, a bookkeeper, and sales or service model development. Some agencies also evaluate different growth strategies like organic revenue growth versus mergers and acquisitions.

Agencies in the growth stage can certainly benefit from hiring a Fractional CFO as the needs for staff planning, compensation planning, data analysis, forecasting, cash flow management, goal setting, strategic planning, and establishing best practice data and financial reporting become more important to the leadership team.

Maturity Stage

Once an agency has established its identity and position in the market and achieves a sustainable momentum there emerges more needs to optimize operations, de-risking the organization, managing profitability for stakeholders, and exploring opportunities for continual growth. Strategic financial planning becomes a necessity for distribution planning of shareholders, keeping a pulse on the enterprise value of the agency, continual analysis, and guidance of company performance, or analyzing potential M&A or program opportunities.

As agencies emerge from the growth into the maturity stage it tends to have an in-house accounting and finance department due to the number of transactions processed. It is common for agencies with up to $10,000,000 in revenue to operate without a full-time CFO on staff. Agencies between $2,000,000 and $10,000,000 in annual revenue can experience tremendous value working with a Fractional CFO to leverage executive-level experience on these components without full-time commitment.

Key Takeaways

- It’s important to evaluate what stage your agency may be moving toward and plan your staffing for upcoming needs.

- Varying financial staff roles make sense at various times within an insurance agency. Bringing in the right skills at the right time will enable you to keep momentum and accomplish your goals.

- A Fractional CFO is a terrific way to access executive-level insight and guidance before the need for full-time roles.

Interested in learning more about how a Fractional CFO can help your agency? Complete our fCFO inquiry form or schedule an introductory call.

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us